The Labor Department’s fiduciary prohibited transaction exemption to align with Reg BI went into effect Tuesday. Satyam Khanna, a former senior legal counsel to former SEC Commissioner Robert Jackson, is filling that role. The SEC recently created a new position, senior policy advisor for climate and ESG, in the office of acting Chair Allison Herren Lee. “Although his public comments have been a mixed bag, including criticism and defenses of various developments in the digital asset space, he is by virtually all accounts an expert in the area and has the appropriate experience and knowledge to make informed policy judgments,” the Ropes & Gray attorneys state. Gensler is currently a professor of blockchain, digital currency, financial technology and public policy at the Massachusetts Institute of Technology, and senior adviser to the influential Digital Currency Initiative of the MIT Media Lab. Gensler’s arrival may also “accelerate the SEC’s timetable for approving Bitcoin ETFs, which has stalled in part due to view that even the most stable tokens will need to be better regulated before receiving approval to be traded on a major exchange,” Ropes & Gray attorneys Jeremiah Williams, Helen Gugel and Stefan Schropp wrote in a recent briefing. “It is a principle-based reg it’s not rule-based, so there will be a lot of interpretations as to … what will be sufficient to satisfy the rule.” “The question just becomes the level of enforcement of the rule and the scrutiny and how it will be interpreted,” she said on the webcast. Sandra Grannum, partner at Faegre Drinker, agreed. And it also is a rule that has a compliance obligation attached to it, which has essentially a failure to supervise component embedded in there.” It’s a tool kit in enforcement’s arsenal … a disclosure-based rule that they can examine for and enforce.

Jim Lundy, partner with Faegre Drinker in Chicago, said on the firm’s recent Inside the Beltway webcast that, particularly in the near term of Gensler’s tenure, the SEC “will enforce Reg BI. The SEC’s “flawed interpretation of fiduciary duties arising under the ’40 Act, a replacement for the misleading (by its very name) Regulation Best Interest, and a re-write of the Form CRS language,” await Gensler’s attention, along with a hard look at environmental, social and governance focused investing, according to Rhoades. Investors should have access to daily short interest data and not the stale twice-monthly data we get now.” Reg BI, ESG and Bitcoin “We need better disclosure on short selling and securities lending. “Our antiquated two-day settlement system needs to be sped up,” Angel explained.

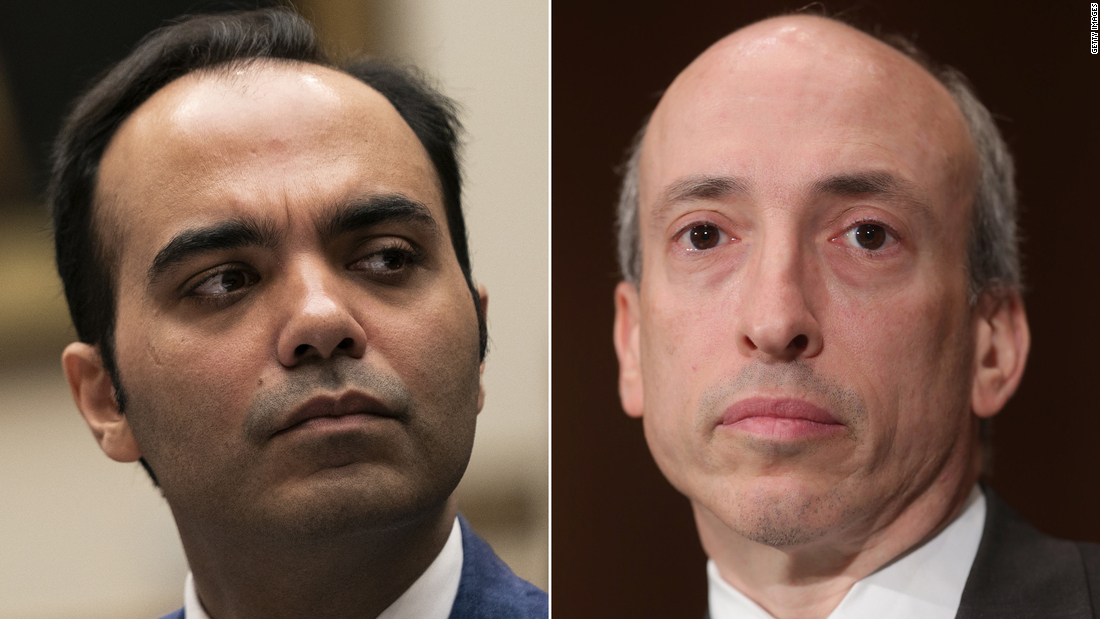

#Gensler confirmed scrutiny top wall street free

“The issues seen around trading in GameStop might be the most visible, and I anticipate some form of enforcement action addressing the marketing of ‘free’ stock trades to individual investors,” Rhoades told ThinkAdvisor in an email.īarbara Roper, director of investor protection for the Consumer Federation of America, added in another email to ThinkAdvisor that “because key investor protections, including, only come into play when a recommendation is made, Robinhood is free to give its customers easy access to risky trading strategies, and to use psychological nudges to encourage those strategies, without being held accountable for the appropriateness of those actions. Once confirmed, “a huge number of issues await” Gensler, according to Ron Rhoades, director of the personal financial planning program and assistant professor of finance in the Gordon Ford College of Business at Western Kentucky University. Incoming Securities and Exchange Commission Chairman Gary Gensler faces numerous tasks once confirmed by the Senate, with the Reddit GameStop squeeze likely front and center.

0 kommentar(er)

0 kommentar(er)